1Q 2021 Review: What’s Next For Stocks, Real Estate, And Bonds

- Get link

- X

- Other Apps

Get a FREE domain when you buy Shared hosting!

Save up to 80% on Domain & Shared Hosting bundle

Just $0.99! Get a popular domain today!

Namecheap Bundle Deals: FREE domains & 45% off shared hosting!

Earlier than reviewing my 1Q 2021 and discussing what’s subsequent for numerous asset lessons, let’s discuss onerous issues.

Ready for the opportune time to suggest to the one after shopping for an engagement ring is tough. The ring simply begins burning a gap in your pocket. However have you learnt what’s even more durable? Writing an April Idiot’s Day publish and never responding to a single remark for 2 days! I’m sorry for tricking y’all people. I hope you’ll forgive me. I’m a jokester at coronary heart.

Ever since I used to be a child, I’ve additionally been a dreamer. Over time, I’ve observed the extra you dream, the extra good issues have a tendency to return true. It have to be as a result of one half constructive mindset, one half taking motion to realize your targets. Should you go about your day-to-day like a zombie, by no means dreaming about a greater future, I’m undecided something particular will ever occur.

Shopping for that beachfront dream residence in Hawaii prices nearer to $15 million, not $10 million as the net estimates say. Sadly, there’s no approach I can afford it. The humorous factor is, one in all my good pals can simply afford it, but he nonetheless refuses to reside it up!

If the home can earn a $900,000 a 12 months internet working earnings, a 4% cap fee would give it a valuation of $22,500,000. Nevertheless it in all probability earns nearer to $500,000-$600,000 a 12 months as the home sits empty more often than not when asking between $85,000 – $250,000 a month in lease.

When doubtful, observe this actual property investing rule: Purchase Utility, Hire Luxurious. It’s less expensive to lease a luxurious residence than to purchase one. The continuing upkeep prices are a killer.

1Q 2021 Evaluate General: 3.75/5

1Q 2021 glided by shortly! General, it was a hopeful time as a result of better-than-expected progress with the vaccine rollout. For instance, in San Francisco, everyone seems to be eligible for a vaccine beginning April 15, 2021, versus the previous expectation of Might or June 2021. Now we simply have to attend for the vaccine trial knowledge to return out for younger youngsters someday in the direction of the top of the 12 months.

Financial Samurai is buzzing alongside as typical. My spouse and I up to date one other 200 posts or so within the quarter. By the top of 2Q 2021, all posts on Financial Samurai ought to be totally up to date. It’s been a blast to revisit a few of the older posts from 2012-2015. The important thing recurring theme is sticking with issues for the long run. Good issues are inclined to occur when you maintain at it.

On the household entrance, the children are doing properly. Our daughter is strolling everywhere now so we’ve padded all of the flooring and corners. She is such a pleasure to carry day-after-day. Our son obtained right into a language immersion preschool that goes by way of the eighth grade beginning this August. It’s good to sit up for some modifications. It’s additionally time for him to fulfill some pals his age.

1Q 2021 Inventory Portfolio Evaluate: 1/5

1Q was fairly unstable. My progress shares like Tesla and Netflix obtained HAMMERED as traders rotated into outdated economic system shares. What’s annoying is that I had felt there was a 65% probability tech shares would underperform. Nonetheless, I didn’t do something about it as a result of I didn’t need create any capital features tax legal responsibility.

When my progress shares have been getting pummeled, it didn’t really feel as dangerous this time as a result of that they had all risen a lot. All of the features since March 2020 actually really feel like humorous cash. Fortunately, many of those progress shares started to rebound in the direction of the top of March. Let’s hope it continues.

After the sell-off, I made a decision to purchase $30,000 in ARKK, Netflix and Tesla in the direction of the top of March. I figured if I’m going to carry many of those names for the long-term, I’d as properly proceed to purchase after a correction.

For solely S&P 500 index traders, 1Q 2021 was a implausible quarter, up about 5.8%. However my portfolio underperformed and closed up solely 2.53% as a result of my heavy tech weighting. Additional, bonds had a horrible quarter as properly.

Subsequently, inventory pickers, watch out what you would like for! Typically you win, generally you lose. On this case, I’m a loser. Discover the widening hole between the orange line and the blue line in my Private Capital portfolio tracker.

1Q 2021 Actual Property Evaluate: 4.5/5

As extra time goes by, it’s turning into clear shopping for actual property in the summertime of 2020 and holding onto all actual property belongings till now has been a shrewd transfer.

Demand for single-family houses is powerful in San Francisco and all around the nation. My tenants have continued to pay on time as they’re all gainfully employed. There have been no upkeep points. Additional, there’s a revival in industrial actual property underway.

The one blemish to an in any other case 5/5 quarter is that my rental property transform continues to be lagging. I lastly obtained our reworking plans authorised on 3/9/2021 after 2.5 months of ready. Nonetheless, supposedly, the Constructing Division has not referred to as again my contractor to schedule the inspections regardless of repeated inquiries.

Every month that goes by is at the least $1,500/month in misplaced lease. I by no means plan to do one other main transform once more. Reworking is an adolescent’s recreation.

1Q 2021 Web Price Evaluate: 3/5

Because of sluggish inventory market efficiency and never altering any estimates on my actual property holdings, enterprise holdings, or various investments, my internet price grew 3%. Discuss unexciting. Maybe if I make to market all investments, my internet price is likely to be up nearer to six%.

Since leaving work in 2012, my goal internet price progress fee has been 10% a 12 months. My aim is to beat nominal inflation by at the least 5% a 12 months and to develop my wealth in a much less unstable approach. Previously, in my 20s and 30s, I used the S&P 500 as my internet price progress benchmark. At present, I really feel ecstatic if I can attain 10%.

I seldom replace my actual property holdings as a result of I’m targeted on the money stream they generate. Web price is sweet, however it’s the passive earnings to pay for our residing bills that counts probably the most. Additional, I wish to be stunned on the upside years down the highway if I ever need to promote.

As for my investments in alternate options, they’re onerous to measure as a result of they’re largely in 5-10 12 months funds. As for my on-line enterprise holdings, I don’t care as a result of I don’t plan to promote.

What’s Subsequent For Shares, Actual Property, And Bonds?

At the start of the 12 months, my crystal ball had the next estimates by year-end:

- S&P 500: 4,088 (+8% YoY, $170 EPS estimate, 24X P/E)

- US Median Actual Property: +5% YoY

- 10-Yr Bond Yield: 1.25% common (began the 12 months at 0.91%)

All three estimates are presently seeking to be too conservative given the S&P 500 is already at 4,019. The US median residence value is up 11% as of January 2021, the quickest clip in 15 years. In the meantime, the 10-year bond yield is at 1.68%.

Shares

There’s nonetheless an opportunity all my predictions might come true. Nonetheless, 4,200 – 4,300 now appears extra possible on the S&P 500 by year-end as a result of a strong earnings rebound and an accommodative Fed. As an alternative of the S&P 500 earnings rising by 30% YoY to $170/share, we might maybe see $180-$190/share. Utilizing a 23X a number of results in 4,140 – 4,560 on the S&P 500.

At this fee, it’s actually onerous to see the Fed wait till 2023 to hike charges because it indicated throughout its final assembly.

Actual Property

Can actual property proceed to go up by double digits year-over-year? I doubt it as 2Q, 3Q, and 4Q comps get more durable. With rates of interest ticking up, increased costs, and more durable comps, the US median residence value progress will possible decelerate. I’m now estimating a 7% YoY value change for all the 2021, up from 5%.

Traditionally talking, something above 2-3% is a implausible 12 months for actual property value progress. Because of leverage, the cash-on-cash returns can be great.

Provide ought to improve within the second half of the 12 months, making it simpler for homebuyers. If you wish to purchase property, I’d deal with offers in huge cities like New York. I’m very assured there can be an enormous snapback in demand. Personally, I’m in search of a pied-de-terre in Manhattan.

The actual property freight prepare has a ton of momentum for a number of extra years. The millennial technology is of their prime residence shopping for years. Subsequently, I’m nonetheless a purchaser.

Bonds

There’s now in all probability solely a 30% probability the 10-year bond yield will common 1.25% for the 12 months. Threat-appetite is just too sturdy because the economic system roars again. Subsequently, I’m elevating my 10-year bond yield common to 1.65% for the 12 months.

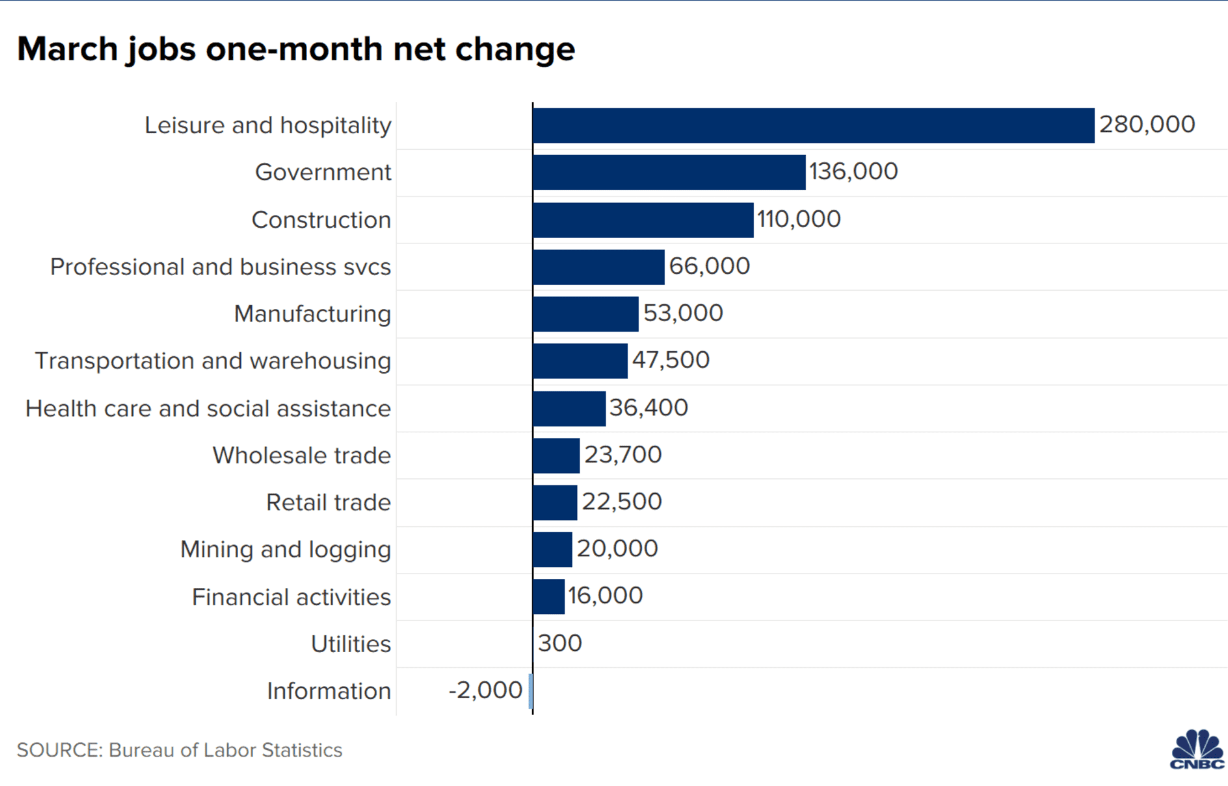

The US added again 916,000 jobs in March, the strongest acquire in 7 months and higher than expectations. The official unemployment fee is now 6%, down from 6.2% in February. General, the US has now gained again 13.7 million jobs (62%) of the 22.2 million jobs misplaced for the reason that begin of the pandemic.

Take a look at this chart that exhibits the place job features have been highest: leisure and hospitality.

There’s now a better chance the 10-year bond yield will hit 2% versus return down under 1%. To this point, the inventory market and actual property market are taking increased rates of interest in stride. ~3.3% for a median 30-year fixed-rate mortgage continues to be low cost, particularly when you’ve stored your job and have seen your inventory portfolio balloon by 20%+ over the previous 12 months.

If the 10-year bond yield hits 2%, I’ll be shopping for bonds once more. I simply hope we don’t hit 2% till the very finish of the 12 months. If we hit 2% by the summer time, I anticipate to see at the least a 5% correction within the S&P 500 because the risk-free fee various will look to be comparatively extra engaging.

You probably have debt, the upper rates of interest go, the much less inclined try to be to pay down debt. Your current debt rate of interest turns into comparatively extra engaging. In different phrases, the worth of your debt with a locked-in fee has gone up.

Getting The Path Appropriate Is The Most Necessary Factor

As an investor, so as to make cash, your most important aim is to get the course appropriate. It’s very tough to pinpoint precisely the place one thing will find yourself. My direction-calling (shares up, actual property up, bonds down for 2021) has led me to maintain my positions the way in which they’re. I’ve simply been including to some positions with new capital.

You might get the course appropriate and go on huge leverage to get wealthy faster like Archegos Capital. Nonetheless, you simply have to additionally concentrate on the results. I actually don’t suggest inventory traders go on margin.

At present, I’m barely bullish on shares, bullish on single household houses and industrial actual property, and nonetheless barely bearish on bonds.

My current internet price allocation, excluding enterprise fairness, is about 30% shares (70% index funds, 25% largely in tech shares), 40% actual property (contains actual property crowdfunding), 20% bonds (largely CA munis), 8% alternate options (enterprise debt, personal fairness), 2% risk-free.

If I had $1,000,000 to take a position proper now I’d:

- Make investments $400,000 in hospitality and industrial industrial actual property offers

- Make investments $200,000 in my favourite tech shares or funds which have corrected by 20%+

- Repay $150,000 remaining in a trip property mortgage that’s caught at 4.25%

- Sit on the remaining $250,000 till there’s one other 5%+ correction within the S&P 500 or one other 10%+ correction in a few of my favourite tech shares. Manhattan actual property can be actually calling to me.

General, 1Q 2021 was an excellent quarter. I proceed to anticipate 2021 to be a worthwhile 12 months. By June 1, 2021, everyone I do know can be totally inoculated. Then, I believe it’s actually time to get pleasure from our wealth extra.

Readers, how was your 1Q 2021? What are your forecasts for the remainder of the 12 months? Do you suppose the great instances can proceed? How would you make investments $1,000,000 proper now? You may join my free weekly publication right here.

<!–

–>

To Check All Free Online Tools, Please Visit: ToolsNess

To Free Download Video From Any Websites

Check our new Free Video Downloader, Please Visit: Any Video Downloader

For Free Link Management System and URL Shortener, Please Visit: Free URL Shortener

For Fun and Quiz Game Please Visit Friends Dare Quiz

Also You Can Visit Our Blog for Latest Update & Tips

Source link

#Evaluate #Whats #Shares #Actual #Property #Bonds

- Get link

- X

- Other Apps

Comments

Post a Comment